Philanthropy: The bequest net of fees and charges, a “win-win” strategy

As the law currently stands, a testator wishing to bequeath all or part of his/her estate to a distant relative or a third party is subject to particularly high inheritance taxes. Transmission using a philanthropic approach may prove to be less costly from a tax perspective.

In the case of a bequest to a distant relative or a third party, a flat tax rate of 60% is applied to the inheritance in the absence of family ties, or 55% for nieces and nephews.

In view of this dissuasive tax system, a testator may prefer to pass on his/her estate as part of a philanthropic initiative. This solution would be less costly from a tax point of view.

Such a transmission would meet two objectives:

- First, to participate in the financing of a cause in the public interest by bequeathing his/her estate, in whole or in part, to a nonprofit organisation,

- Second, reward a loved one without putting him/her at a financial disadvantage.

The transmission would be carried out as follows: the testator first designates a non-profit organisation as universal legatee of his/her estate; this organisation would then be in charge of delivering a determined inheritance to a specific person.

Modus operandi

Specifically, the testator designates one of the non-profit organisations referred to in Article 795 of the French General Tax Code as universal legatee of his/her estate.

Normally, an organisation established as universal legatee receives the entire estate. However, a testator can designate one or more universal legatees; the universal bequest may concern only the part of the estate remaining after specific bequests have been allocated, or even just the portion available when there are rightful heirs.

The proposed transfer of the estate will take place free of tax. In fact, legacies granted to organisations covered by law are exempt from all transfer duties.

In addition, the will should specify that the beneficiary non-profit organisation will be in charge of delivering a special bequest, net of fees and duties, to a loved one (for example a nephew) who the deceased wishes to reward.

In this context, the organisation receiving the bequest would pay the inheritance tax relating to this legacy (55% in the case of a nephew) in place of the heir in a private capacity. In this regard, note that when the organisation is in charge of paying the duties, that amount is not considered part of the inheritance for tax purposes and is not subject to inheritance tax.

The organisation will thus pay the beneficiary an amount at least equivalent to and possibly greater than that which would have remained in the estate if he had received the assets directly and paid the inheritance tax.

In this way, the individual heir receives the agreed-upon sum net of tax duties and obligations. The latter is thus no longer responsible for declaring and paying the inheritance tax within 6 months or possibly constrained to liquidate certain assets in the estate. The administrative procedures and payment of the tax are the sole responsibility of the organisation.

To summarise, the inheritance tax will still exist, but the responsibility for it changes. In addition, the tax basis for the free inheritance tax is lower, since the duties are calculated on what is actually transmitted to the individual legatee.

In addition, this scenario allows the disposing party to avoid depriving him/herself during his/her lifetime and to transmit his/her estate upon his/her death under more acceptable tax conditions.

Illustration with figures

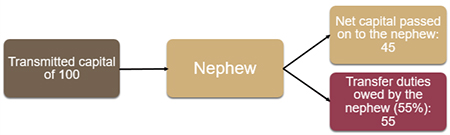

Context: Mr X has an estate of 100. He has no direct descendants and wishes to transmit his estate to his nephew.

Case 1: transmission as-is

Case 2: transmission using a philanthropic approach

Note: in Case 2, the nephew ultimately receives the same amount as in Case 1. The philanthropic approach desired by Mr. X has therefore not harmed his nephew’s financial situation. The tax savings realised is allocated to a philanthropic project.

Precautions to be taken

First, the philanthropic intention of the testator must be ascertained. Care should also be taken over time to ensure that the organisation fulfils its public interest mission. The organisation must not serve as a simple “estate intermediary” between the testator and his/her heirs.

In order to avoid any potential reclassification in view of abuse of tax law, care should be taken to ensure that the non-profit organisation has sufficient liquidity to carry out its public interest mission.

As a precaution, it could be recommended not to exceed what the individual legatee would have received without the intervention of the public interest organisation.

Given the articulation of all these elements, a qualified counsel (notary) should be called upon to assist the disposing party in implementing the transmissions. The will should be very precisely written. Given all of this, there could be a provision in the will for a substitute universal legatee, for instance.

April 14, 2020