Vulnerable optimism?

Macroeconomic data for the past few weeks has not been as bleak as one might have expected. But is this enough to justify a 20% rebound in equities? Not necessarily.

Since mid-October, equity markets have risen strongly, beyond the expectations of most strategists, especially if one recalls the context that prevailed two months ago: a near-crisis situation in the UK, unwinding of positions by pension funds and, more generally, a rise in long-term rates that was detrimental to equity markets.

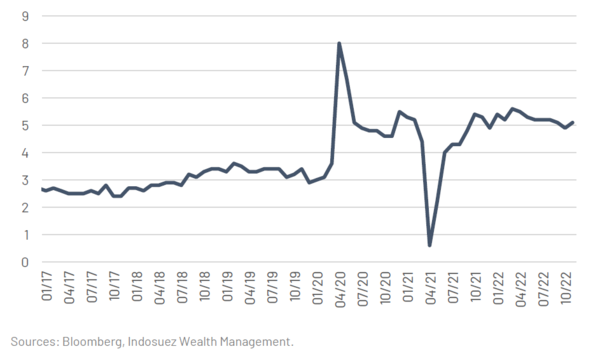

Since then, renewed optimism has been driven by several factors. Firstly, macroeconomic data are still weak, but less deteriorated than expected. This is reflected in the improvement of the economic surprise indicator since June (Chart 1). Secondly, an earnings season with a rather high level of positive surprises in a difficult context, maintaining a strong divergence between the macroeconomic and microeconomic spheres. Thirdly, a stabilisation of core inflation and the beginning of a decline in total inflation in the United States has given rise to the idea of a forthcoming Fed pivot, with the next rate hikes being lower and potentially more spaced out, with the idea that the terminal rate will be reached in the spring of 2023. It is indeed the decline in long term rates over the last few weeks that has been the main driver behind the market rally.

The strength of the dollar has also helped European equities to perform this autumn, particularly stocks of exporting companies such as in the luxury sector. Finally, if we add to this a renewed optimism about China linked to signals of an easing of their zero-COVID policy, we better understand what is leading investors to take risks again.

But is that enough to justify a 20% rebound in equities? Not necessarily.

Chart 1: Citi Indicator of economic surprises: Europe (points)

Let's start by highlighting a paradox. The equity markets still seem to be trapped in a "bad news is good news" reading, seeing each weakening of the growth trend as a reason to believe in a more accommodating policy from the Fed, which has clearly stated that its priority is the fight against inflation, even if this comes at the price of a strong economic slowdown. The other side of this paradox is that the markets seem to be looking directly to the next chapter, by anticipating rate cuts at the end of 2023, without worrying too much about what might happen in the meantime. That is, a probable deterioration in fundamentals (falling margins, contraction in earnings in a majority of sectors in the US in the fourth quarter) and a deterioration in economic conditions with a lagged effect into 2023. Let's now turn to what matters most to the Fed: the labour market. This is where another recent paradox lies: long term rates continue to fall while job creation surprises to the upside and wages continue to rise and even accelerate.

On Friday 2 December, US employment data for November showed a 0.6% increase in wages over the month (and

0.7% in the private sector), i.e. 7% on an annualised basis, the first time this has been seen for 10 months (Chart 2). Despite monetary tightening of a magnitude unseen since the 1970s and a sharp economic slowdown (contraction of US GDP in the first half of the year), the US labour market is showing no signs of slowing down.

The main explanation for these wage increases remains the reaction of wages to the surge in inflation experienced over the past year, which has gradually spread to the rest of the economy. This has led to wage renegotiations, sometimes with a delayed effect. Some also see it as a direct consequence of the labour shortage generated by the accelerated exit of older workers from the labour market since the COVID-19 pandemic. Others see it as the translation of a fundamental demographic movement: the reversal of the impact of demography on inflation. The ageing of the population was supposed to explain low structural inflation; but in reality, after having had a rather disinflationary impact from the presence of the baby-boomers on the labour market, the retirement of people born up to the beginning of the 1960s (when the birth rate fell below 25%) is causing a more structural imbalance between age groups and a deeper difficulty for companies to recruit, resulting in higher wages.

We continue to expect a turnaround in employment in 2023 and more moderate wage increases. In Europe, we expect activity and employment to contract in the first half of the year. But this continuation of high wage growth in the US should be of more concern to the market as it justifies the Fed's willingness to continue to raise rates and especially to keep them high until the labour market returns to a more normal regime. This could lead to a return of volatility around the Fed meeting and at the beginning of the year. The issue is not the size of the December rate hike (the 50 basis points hike is almost a given) but rather having a slightly higher terminal rate and a longer than expected high rate plateau.

Chart 2: average hourly wages (year-on-year, %)

December 07, 2022