US GDP: not quite recession

US real GDP has now contracted for two consecutive quarters, which qualifies as a “technical recession” even if it is not yet considered as such by the NBER1. Instead of a cold shower, financial markets took the news pretty well. The threat of recession is indeed seen as the only factor capable of halting the Fed’s aggressive tightening path. But the market could be getting a little ahead of itself.

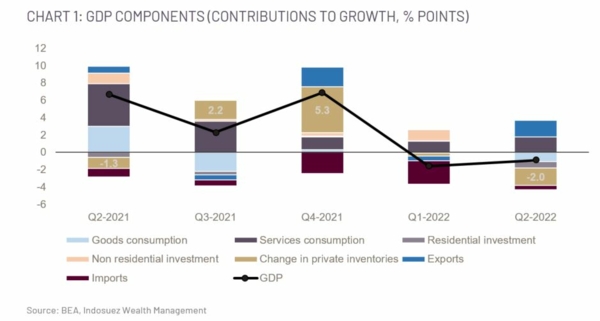

Chart 1: GDP components (contributions to growth, % points)

The figures

In the second quarter of 2022, the US economy contracted by 0.9% on an annual rate compared to Q12, after falling already -1.6% in Q1. First the good news: the underlying picture was better than expected on the demand side. Total private consumption (~70% of US GDP) rose 1% on an annualized quarterly basis, thanks to strong demand for services (4.1%) that outweighed the collapses in goods (-4.4%). This is in line with monthly data releases on personal consumption expenditure (PCE) that jumped by 1.1% over the month of June, thanks in part to the fall in the personal savings rate (-0.4 points in Q2). Exports rebounded strongly (+18% after - 4.8% in Q1-22), while imports weakened in line with the fall in goods consumption and despite the strength of the dollar. But that is where the good news stops, as investment plunged 13.5%, pulled down by the housing component (home sales decreased 5.4% Month-on-Month in June) as well as inventories that were rebuilt at a lower rate than in Q1. Nonresidential investment remained stable and will be a key indicator to watch in the coming quarters. Government consumption also weighed on growth. In 2021 inventories had significantly supported growth as supply bottlenecks pushed retailers to build up stocks; today this has reversed. US retailers such as Walmart have slashed their profit forecasts end of July mentioning the need to cut prices in order to cutback on inventories. Without this negative contribution from inventories (shaving 2 percentage points off of growth in Q2, see Chart 1), activity would have progressed by approximately 1%, adding a clear upside risk to Q3 GDP as this negative component wears off. It is also important to note that this is the “advanced estimate” for Q2 and that more complete data on GDP will be released on the 25 August.

Recession: What is in a name ?

Real GDP has now contracted for two consecutive quarters, also known as a technical recession. However, the NBER, which is responsible for officially determining recessions in the US, uses a broader approach to define a recession. They take into account the sum of US expenditure (Gross Domestic Product), but also the sum of incomes (Gross Domestic Income, which will be published next month and increased by 1.8% in Q1) as well as a number of monthly indicators (such as non-farm payroll employment which remained strong in June). The NBER has therefore not officially declared the US economy in “recession”. This was highlighted by J. Powell during the July FOMC: the US economy is not showing signs of a « broad-based decline » of activity affecting many sectors, suggesting that a technical contraction in GDP would not be sufficient to derail the Fed’s agenda (see CIO Perspectives - FOMC meeting: an excessively optimistic market reaction?).

That being said, going forward demand is expected to soften under the weight of the Fed’s actions. July figures have left little room for enthusiasm on the demand front, but still strong corporate balance sheets and the jobs market could will cushion the impact in Q3:

- Michigan consumer survey has recovered slightly, but remains at recession levels, while the Conference Board consumer survey (which historically has been more linked to changes in the jobs market) fell 2 points to 95.7 in July;

- The US PMI survey for services was in contraction territory in July (at 47, below the 50-mark threshold) and edged lower in manufacturing (52.3);

- The housing market, at the heart of the US economy, took a bad hit in July, with the NAHB (National Association of Home Builders) housing market index down to 55 points (from 67 in June), significantly below consensus (65). The latter is a bad omen for the future of the jobs market;

- Jobless claims – the last domino to fall - are starting to rise (averaging around 250 k in July compared to 225k in June), but remain far below their long-term average (410 k). In such a tight market, wages and salaries continued to rise (1.4% QoQ in Q2 vs. 1.2% in Q1).

With both a strong contraction in Q1 and Q2 GDP and assuming the economy remained stable with no growth until the end of the year, the 2022 annual GDP growth rate would be at 1.4% for the US economy thanks to a strong growth carry-over effect from solid 2021 figures. Most forecast for the US economy are therefore obsolete unless we get a very significant surprise in Q3 which is unlikely. This includes the IMF’s recent projections that the economy would progress by 2.3% in 2022 and 1% in 2023 (already revised down by 1.4 percentage points and 1.3 percentage points, respectively).

Market reaction: ignorance is bliss?

Financial markets rallied initially on this GDP release, with the threat of recession seen as the only weapon to halt the Feds aggressive tightening path. On the 28 July, the S&P 500 rose 1.2%, the Dow Jones industrial average gained 1%, and the Nasdaq 1.1%. Bond yields were broadly lower: the 2-year US Treasury yield fell to 2.87% (vs. 2.98% the day before), while the 10-year yield fell to 2.68% (from 2.74%). Furthermore, markets anticipated Fed fund rates to land at 3.24% end 2022 and 2.64% end 2023, both less than anticipated the day before. This weighed on the USD that has been strongly supported by the favorable interest rate differential. Nevertheless, the greenback could also bounce back on weaker economic data releases as it remains the reference safe-haven currency.

The length and extent of this market rebound will depend highly economic data in July, as the Fed is looking for “compelling” evidence that inflation is slowing. The latter will not be comforted by recent the PCE inflation release (up from 6.3% to 6.8% in June). Therefore, this summer look out for the following key dates:

- 5 August: US employment data

- 10 August: US inflation

- 25-27 August: Jackson Hole Symposium (Fed statements)

1- National Bureau of Economic Research

2- The equivalent of -0.2% Quarter-on-Quarter (QoQ)

August 03, 2022