US economy: keeping the Fed on its toes

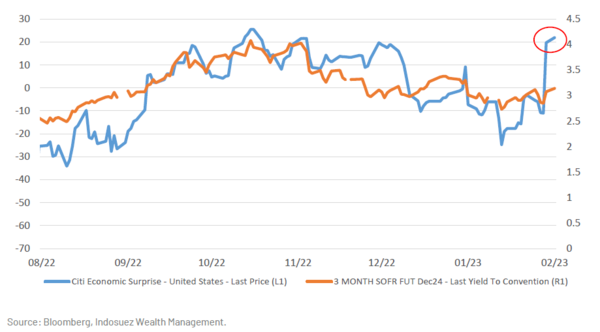

In early February, the US economic surprises index returned to positive territory (Chart 1) after the January jobs report exceeded the most optimistic forecasts. This leaves the Fed no choice but to remain hawkish, and financials markets with room for disappointment.

US economy: prepares for landing?

While economists are scrambling to figure out if the US economy is heading for a soft or a hard landing, consumers were considerably more upbeat in January. The University of Michigan consumer sentiment survey rebounded to 64.6 points (versus 56.8 initially estimated in early January). Consumers were especially more upbeat on their current situation. Their 12 month inflation expectations fell below 4% for the first time since April 2021. The fall in prices (notably automobile and airfare) is indeed helping to improve sentiment. Gasoline prices are down over 10% compared to this time last year, also providing a boost to sentiment. But the key element behind consumption remains the solidity of the labour market.

Chart 1: US economic surprises index and future short term rate (December 2024)

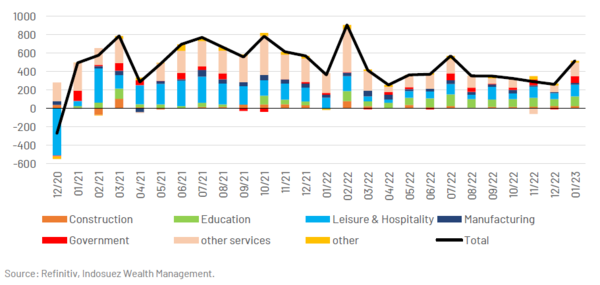

January payrolls soared by 517 thousand (considerably above the consensus of 188 thousand), with the most significant rise in the Leisure and Hospitality and Education sector (Chart 2) and possible season factors adding noise to the figures. Wages continue to increase (average hourly earnings rose 0.3% month-on-month) in January (4.4% year-on-year), albeit at a slower pace. Inflation adjusted wages remain negative, but the gap between the increase in consumer prices and the increase in wages has narrowed considerably from 3.6 percentage points in June to 2.1 in January. Furthermore, it is questionable as to whether wages will continue to moderate given the historical tightness in the US jobs market (with still two job openings for every unemployed person).

The impact of higher rates is beginning to seep into the real economy, although with a lag given the lower debt loads of households compared to pre-pandemic. The stabilisation in mortgage rates over the last month is also helping to stabilise the real estate sector. But households can no longer rely on their savings buffers and will difficultly be able to continue turning to credit cards given the surge in rates. Inflation-adjusted personal consumption expenditure dropped 0.3% in December (services continue to rise, but durable goods fell by 1.6% in December). Although it is expected to recover slightly early 2023, notably after a severe weather shock at the end of the year, we expect consumption in the US to moderate mid-2023, without collapsing given the ongoing strength in the labour market and services sector.

The recession is therefore not in our figures for 2023, giving the Fed the difficult task of possibly overtightening in this still very imbalanced service-led post-COVID economy. According to the Atlanta Fed estimates, US GDP should progress 2.1% in Q1 2023 on an annualised basis (previous estimate was at 0.7%).

Chart 2: US monthly non farm payrolls by sector

Fed: will the data do the job?

After massively front loading hikes in 2022 (350 basis points (bps) in the last five meetings), the Federal reserve is now downshifting to a pace of 25 bps hikes in an attempt to fine tune the landing zone for its terminal rate. For now, the official stance is to hold policy at a restrictive level for a “period of time” and possibly raise rates “more than is priced in” by markets (February 7).

The early February FOMC statement leaned a little hawkish compared to expectations while the press conference struck a more optimistic tone. Chairman Powell - with his hope for a soft landing - did not push back on the recent easing of financial conditions and acknowledged the start of a "disinflationary process". This was a clear dovish signal as J. Powell sounded very different from his August 2022 Jackson Hole address. Is this surprising? No. The FOMC remains clearly “data dependent” and the recent moderation in wages and the deceleration in inflation since the summer of 2022 are signs of progress towards their goal.

The market in its binary approach is expecting aggressive rate cuts responding to lower levels of inflation and a deceleration in growth, albeit from high levels. "I continue to think that there's a path to getting inflation back down to 2 percent without a really significant economic decline or a significant increase in unemployment" J. Powell (1 February).

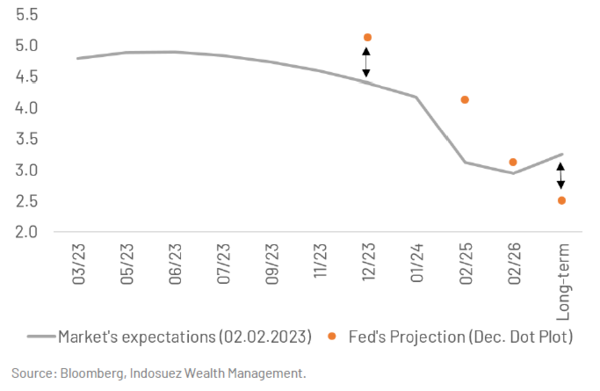

But was this really a dovish stance? It feels dovish, but it is way less dovish than what is priced in by markets in term of rate cuts - almost 200 bps cuts priced at December 2024 (Chart 3). Market wise, the rate cuts priced through the next two years are based on a recession scenario. Therefore, any positive economic surprises (such as the recent ISM and January jobs data) that validates both the soft landing scenario and further Fed hawkishness, make the yield curve and bond prices increasingly vulnerable (Chart 1). The question then is: will Powell let the data do the job?

"I'm not going to try to persuade people to have a different forecast, but our forecast is that it will take some time and some patience and that we'll need to keep rates higher for longer. But we'll see."

Key-takeaways for investors

- In the short-term, the market does not believe J. Powell will keep interest rates high throughout the year. In the long-term, the Fed believes rates will return to "normal." Investors do not.

- Even if we do not buy the hard landing scenario with today’s figures, we do remain cautious in this euphoric environment, as there is a lot of good news already priced into markets, leaving room for disappointment and short-term volatility.

- After this central bank week, rates and yield curves are likely to stay range bound trying to discount the incoming data. The recession pricing seems crowded and any stronger than expected macro data will heavily weigh on the front end of yield curves.

- We see the necessity for increased duration once the peak is reached, not when the Fed pivot is officially announced.

Chart 3: Market VS. Fed expectations for future Fed fund rates

February 08, 2023