Just how tight is the US Labour Market?

Nonfarm payrolls increased above consensus expectations creating a lot of market excitement at the end of last week and in contrast with signals sent by PMI (Purchasing Managers Index) surveys and the increase in the number of unemployed registered in the household survey. But the devil is in the details... Bottom line, with the number of job openings outpacing the number of unemployed in several sectors and in turn putting pressure on wages, the US economy can no longer deny its inflationary pressures despite the omicron-led cooling in activity in January.

Current situation: What’s all the excitement about?

The good news: job creation is higher than expected with total non-farm payroll employment increasing by 467 thousand in January 2022 (vs. 150 K projected by the consensus) according to the establishment survey data of the employment report. Employment growth continued in leisure & hospitality (151K), specially food services & drinking places (108K) and to a lesser extent in the accommodation industry (23K). Compared to pre-crisis levels, employment is still down 10% in leisure & hospitality as well as - 4% in government education and –2% in both healthcare and wholesale trade sectors. It has however surpassed pre-crisis levels in transportation & warehousing and retail trade.

The second part of the employment report – the household survey – is less rosy and impacted by significant population control adjustments that can be misleading when comparing January to December figures. Nevertheless, we can see that the number of unemployed rose slightly in January (by + 194K) to 6.5 million, a number that is however 36% lower than in January 2021. The unemployment rate rose 0.1 percentage points to 4%. An encouraging factor is a significant decrease in the number of long term unemployed (from 32% in December 2021 to 26% in January 2022). The labour force participation rate appears slow to recover at 62.2% (vs. 63.4% in February 2020).

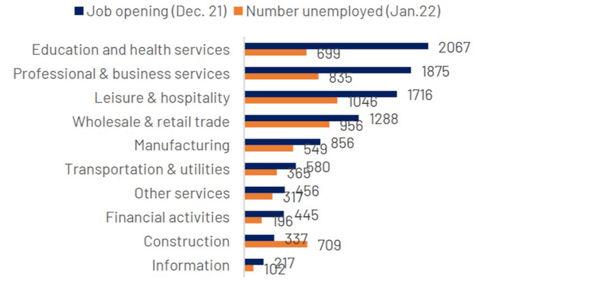

Analysts continue to be puzzled by the gap between job openings and job seekers. Job openings totalled nearly 11 million in the December JOLTS (Job Openings and Labor Turnover) survey, more than 4.5 million above the total unemployment level. Skill mismatches are a regular explanation, notably for jobs in healthcare and education (cf. Chart 1). The number of people going into business for themselves was another explanation as US entrepreneurship is at record highs, even if it appears to be losing momentum (new business applications dropped 3% on a monthly basis in December). Finally, generous COVID-19 unemployment benefits gave some workers the possibility to choose not to seek employment, but the bulk of them ended in Q4-2021. All in all, there is no quick solution to bring a large movement back to work, at least not without a change in salary or training to meet job offer needs.

In this context, average hourly earnings for employees have increased 5.7% on a yearly basis in January (and highest rate in 15 years) and 0.7% over the last month. Unsurprisingly, the highest increases were in the sectors with the largest gaps between openings and unemployed, i.e. the retail sector (+15% year- on-year) and leisure & hospitality (+13%), with healthcare & education increasing in line with the overall average (+6%) despite the urgent need for workers.

All eyes on the Fed while inflation edges higher

This employment data is poignant as the Fed’s average inflation targeting is aimed at allowing inflation to go above target (at 2%) in the interest of achieving full employment. With the labour market “healthy” enough to put pressure on wages, the US economy is no longer immune to increases in prices beckoning a reaction from the Fed.

January inflation is released on the 10th of February. In December the US inflation rate was at 7% year- on-year and the consensus expects this figure to rise to 7.3% in January. If we exclude highly volatile energy and food prices, core inflation was at 5.5% and the market consensus expects 5.9% in January. Components to watch that could potentially prop up inflation again are new and used car prices (that rose 12% and 37% year-on-year in December) and another heavy-weight item to watch is shelter prices (up 4% in December its highest since 2007).

Chart 1: job openings surpass the number of unemployed in multiple sectors (thousands)

Sources: U.S. Bureau of Labor Statistics, Indosuez Wealth Management

February 10, 2022